by Jared West

10 Best Credit Card for Low Income Earners 2023 - Having low income does not mean you cannot have credit card. It is true that with your current income, you need to have great money management. The finance must be handled well in order to get efficiency and effectiveness. Having enough saving must also be considered.

It is quite confusing when there are many kinds of needs to cover, but it does not mean you cannot have credit card. In fact, some banks and issuers provide services, so those with low income still can have credit card. Related to this, there are some recommendations of the 10 Best Credit Card for Low Income Earners 2023.

Contents

Even if you have credit card, you should not be consumptive and you are still able to keep up with your low income. In fact, credit card can be good way of financial management. The card provides efficiency and effectiveness of transaction.

Even, there are benefits and promos that can make your expenses more efficient and effective. That’s why there is no reason to ignore the credit card. Even, it can be said that you need to credit card.

Well, credit cards for low income earners are needed for you. This is the best solution when you need fast access of transaction without burdening your finance. The credit card for those with low income is made with some features and services, so it will never bring more burdens, yet it brings some benefits for them. To give you references, these are some great options to choose.

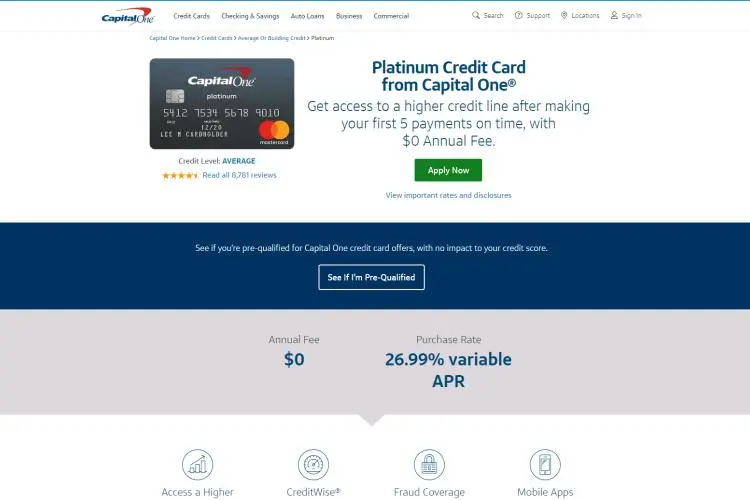

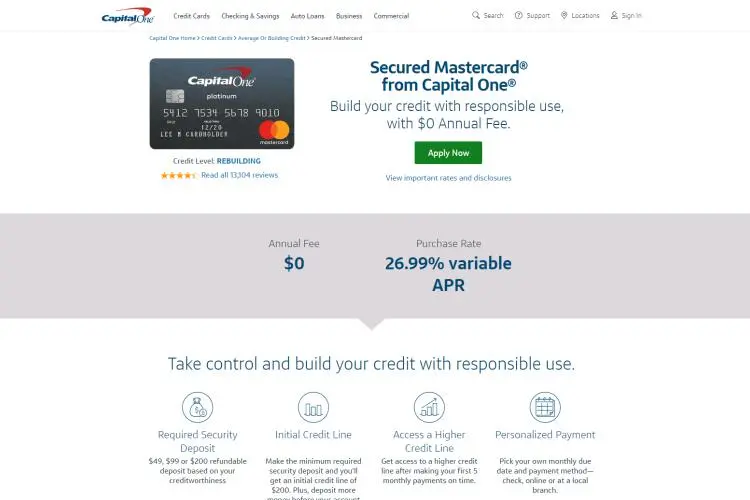

This credit card is the great option since it has no annual fee. This is great and useful feature because sometimes, the annual fee becomes such a burden to worry for those who have low income. Then, when you can make payment on time for the first 5 months, you will get access to have higher credit line.

Even if it is for low income earners, you still can get access for online banking. You can use your smartphone to access the online banking. There is app to make the access easier. The system also works for 24/7, so you will be able to make transaction anytime you want.

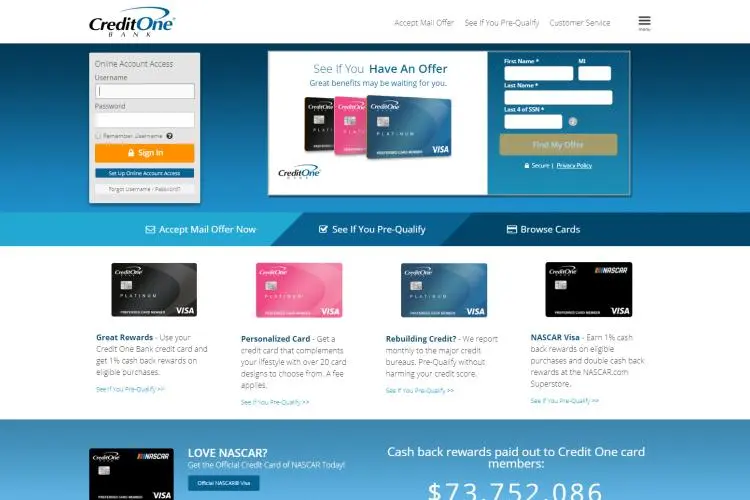

This is the next reference of 10 Best Credit Card for Low Income Earners 2023. When you use this credit card, you will get free fraud liability. Therefore, you do not need to pay any dollars for this. Then, you have easy access to pay the bill since the bank provides access for you to choose the due date.

This can be good point since it offers flexibility. There is also mobile app to use in your smartphone for easier access of account, even for payment and other transaction. In order to get news and notification, your email will get the latest update.

This is one of good options for the 10 Best Credit Card for Low Income Earners 2023, especially in bad-credit history. Sometimes, it is quite hard to get credit card when you have bad credit history. However, this issuer gives access for the credit card.

By using this card, it is like making your new credit history. Then, there is also low rate of monthly payment. It is very useful for your condition with low income. With the lower rate, it will not burden your financial condition, so it is still good to have credit card.

This card offers an easy and fast process of application. In the process, there is still account checking since this is the basic procedure. Other benefit of this card is its easy process of monthly payment.

You can manage your own payment every month, so it is helpful to set your own due date. In addition, it also becomes one of the good credit card solutions for those who have a bad credit history. Although there is still checking of account, it is still possible to get the credit card. Well, this can become good chance to rewrite your credit history for the future benefits.

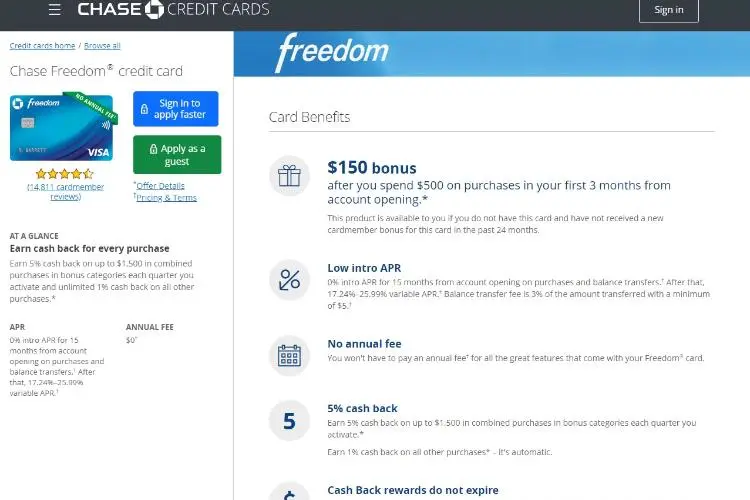

It is the other reference of the 10 Best Credit Card for Low Income Earners 2023. This credit card has good APR as you can have 0% of APR for the first 15 months. Then, you are possible to get bonus up to $150 when you spend $500 or more within 3 months after the credit card is opened.

There are still other benefits offered by this card. For example, you can get cash-back after some purchases. It can be useful for you who have regular expenses because you can get cash back from the transaction.

Those are some recommendations of 10 Best Credit Card for Low Income Earners 2023 to choose. All of them are suitable for your financial income. Even if your income is quite low, as long as it is routine, you still can apply for the credit cards.

All of them are good recommendations and they have special features that make it easier for your condition. With those features and services, you can have good access of payment without any additional burdens. Although there is fee, it will not be too hard for you to pay.

All of them provide easy access as well. Most of them can also give access for online banking. There are also bonus and cash back. These two points are great since you are able to get additional incomes from your transactions.

Every low income earner should get this card. It has Mastercard logo on it, which you can use it anywhere on the world. In fact, Capital One claimed millions of service providers globally accept this credit card for payment. There is no annual fee. So no need to worry about the yearly on-time payment to keep it. They do have the online web account management and mobile app to check monitor the card statement. Another huge plus is the issuing bank ensured to report the user's credit payment history to all three credit bureaus. Which is good for credit builders who want to make a good history on all the major credit reporters. What else? Capital One promised to increase credit line frequently if you maintain a good payment ethics. What you waiting for?

This card is for low income users. It is from Credit One. So it is easy to get. The company has the web portal and mobile app for you to manage and monitor your balance and credit history. Annual fee is there but low. In fact, all cards from Credit One have annual fees. The 1% cash back also helps. The big plus is the Zero Fraud Liability, which projects you from unauthorized charges.

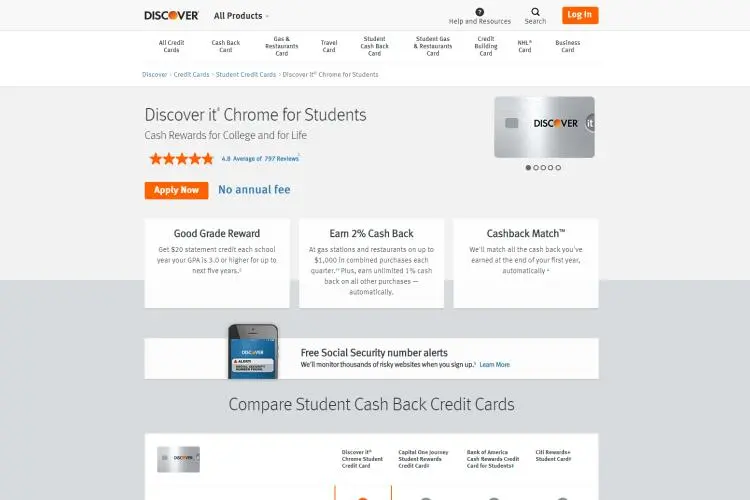

This card is for students, who want to try out the feel of having a credit card for the first time. It has many great features, such as no annual fee, 2% cash back at gas stations & restaurants, cash back match, and outstanding grade rewards. This means you get 2% cash back for eating out and getting gas for your car. 1% cash back for everything else. The APR is low and generous offers on late payments. The outstanding grade rewards would give you $20 statement if your GPA is over 3.0.

Now, you already get the great references of 10 Best Credit Card for Low Income Earners 2018. You will be able to get credit card when choosing one of them. However, it does not mean you can choose them randomly. Each of providers has different features and some consideration is needed in this process. That’s why it becomes necessary to see these tips.

Although the credit cards are set for those with low income, it does not mean no regulations are applied. There must be minimum requirements. Even if the issuers have no restriction for the minimum income, you are the one who should set the minimum rate. Usually, it is safe to apply for the credit card when you have at least $1,500 for regular income in a month. When it is still lower than this, you should consider twice.

This is the other point to consider. Based on those recommendations of 10 Best Credit Card for Low Income Earners 2018, some of them have no annual fee and it is good point. However, mostly there are fees to pay annually. Sometimes, this can be quite burdening. Because of it, you must be sure that the benefits obtained from credit card are good enough compared to the annual fee that you have to pay. This is the basic consideration to make in order to get good balance.

Annual fee is not the only thing to pay. Since you are using credit card, there is interest rate to pay as well. In this case, it is great to find credit card with 55-days interest free since it can reduce your burden. Even if you cannot find this kind of rate, you should be able to find the lowest rate. Therefore, it will not be burden for your finance. In some cases, there are also promotions for the rate. You may look for this matter. It can be quite helpful to save the expenses for the interest rate. Usually, the promotions are given in the beginning and end of year.

This is the interesting thing to consider. Every credit card for low income earners will try to be competitive by giving various features. Of course, the goal is to attract more people applying for the credit card. The features can be different among those credit cards, so you must find the most beneficial one. This is quite tricky to choose, so you must be careful in choosing.

Of course, minimum income is not the only requirement. You need to find all details related to the requirements. Right before you make the decision, you must be clear about requirements and there is no single point missed from your eyes.

When you are still confused to make the choice, it is fine to ask for advice and suggestions. You can ask it from your friends or relatives who have experiences or knowledge about this. It is useful to help you in making good decision.

Low income does not become restriction to have credit card. You have seen that there are some recommendations of 10 Best Credit Card for Low Income Earners 2023 to choose for your financial condition. These are solutions for those who are looking for easy and fast access of transaction. When you really need to have the credit card, you still have to make good considerations. Related to this, those points are helpful as the tips to make a good choice of decision.

About Jared West

Jared's unique approach to audio writing involves meticulously crafting intricate sound designs that serve as the foundation for his narratives. Through careful selection and manipulation of sound effects, ambient noise, and music, he weaves together a tapestry of auditory sensations that bring his stories to life.

|

|

|

|

Check These Out

Time for FREE Giveaways, and Free Gifts to show our gratitude.

Reveal all teh data by disbling adblock. Hit a button below to show all

|

|

|

|